Container volumes on the rise: what does this mean for the future in the port of Rotterdam?

Reading time: 6 minutes

Container volume in the port of Rotterdam in 2024 has increased for the first time in three years, with consumer goods and food products as the main growth drivers. 'This could be a harbinger of further growth, particularly when all the planned capacity expansions have been completed,' predicts Frank van der Laan, Senior Advisor Business Intelligence at Port of Rotterdam Authority. New shipping partnerships also have a positive impact on Rotterdam, 'but we continue to face uncertainties, especially in the geopolitical realm'.

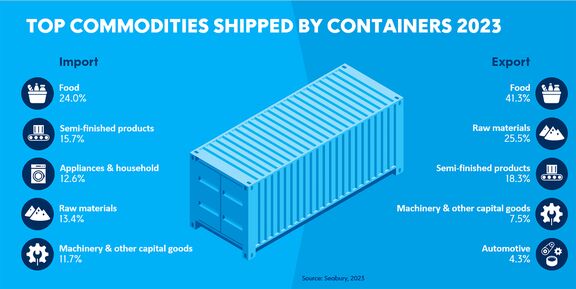

After several years of decreasing volume, the container market saw a 2.8% growth in 2024. A modest, yet significant growth. Containers transport much of the essential freight, such as food, medicine and semi-finished goods for the European industry (see the text box 'Containers in numbers'), and serve as an important link in both export and import.

'Driven mainly by economic growth and increased consumption, volume to the hinterland is rising,' explains Van der Laan. He states that the last few years represented quite an anomaly. 'Covid initially caused a brief drop in volume, but consumption soon rebounded with extreme growth and huge volume increases, as consumers were no longer able to spend money on services. By 2022 Covid was behind us and the situation changed, partially influenced by the Russian invasion of Ukraine.'

This resulted in a significant drop in container volume in the port of Rotterdam as 8% of our volume was Russia-related and a large number of containers from Asia are shipped to Saint Petersburg via Rotterdam. The war also caused an increase in European energy prices, reducing purchasing power, and consequently, consumption. This drop in volume came to an end in 2024. Especially consumer goods, such as electronics, furniture, household appliances and household goods (+17%) and food (+7%) are performing well. Van der Laan states: 'Only high-end exports from Europe are lagging behind. Large energy-consuming manufacturers in Europe, such as the automotive industry, chemical and machine manufacturing, are in a worse position than their competitors elsewhere in the world.'

Transshipments lag behind

Although overall container volume in Rotterdam increased, the transshipment flows (see the text box 'Transshipment explained') have fallen behind. Van der Laan explains two important causes for this: 'Worldwide demand has increased significantly, with 7.4% growth. As a result, shipping companies and terminals saw a major increase in volume. However, this overcapacity vanished overnight when the Suez route became unviable. Shipping lines are circumnavigating Africa, which adds 18 days to their total rotation and requires two to three more vessels per rotation. These extra vessels are not readily available, so shifts are being skipped and the load factor of those vessels that are sailing has gone up. Moreover, punctuality has been extremely low: only one in five vessels from Asia arrived on time in 2024. These delays are partially caused by congestion in a few major hubs, like in the western Mediterranean, due to the reconfiguration of trade routes. And when vessels finally arrive, they have a high volume of containers to unload. This increases pressure on terminal productivity and handling, making most companies choose a port that does have the capacity to handle transshipment volume. Unlike most hinterland flows, transshipment volumes can usually be handled by many ports.'

Transshipment explained

Transshipment cargo is cargo destined for a region that is not accessible to large deepsea vessels. These vessels are only able to dock in a few major ports in Northwestern Europe, including Rotterdam. In these large ports, the cargo is transferred to smaller container ships, also known as feeders, and shipped to its final destination, or vice versa. Examples of countries that rely on transshipment services are Norway, Finland, Ireland and the Baltics.

'Volume will return'

Van der Laan expects that these feeder volumes will bounce back: 'Everything is in place: Rotterdam offers a suitable draught for large vessels, excellent modern terminals and good connections with the hinterland. Our port is also a leader in digitalisation, which is essential for an optimal supply chain. Furthermore, Rotterdam outperforms other ports when it comes to capacity development. Once all terminal investments on the Maasvlakte are completed and we have enough capacity, our already unique position will be further reinforced and I fully expect those transshipment flows to return.'

Suez canal causes biggest impact

Uncertainties, like possible trade barriers and geopolitical developments, remain a factor. 'US tariffs could have an impact on container volumes. And although the US market represents a relatively small segment of only 6-7% for Rotterdam, some parties could experience major consequences,' according to Van der Laan.

However, the developments in the Middle East are generating a much bigger impact. More than 50% of all containers handled in Rotterdam come from Asia. 'It would be a very good thing for Rotterdam if the Red Sea route reopens and smooth sailing, literally and figuratively, resumes for our supply chain, allowing for an increase in effective capacity,' affirms Van der Laan. 'At the moment shipping companies are waiting to see if the cease-fire between Israel and Hamas will hold and how the situation develops. The reopening of the route would normalise supply chains and provide faster transit times and thus lower shipping costs. There are signs that this could happen in the foreseeable future.'

New alliances are good for Rotterdam

There is one area where shipping companies have already made some big decisions, and that is in partnerships. The year 2025 will see a major reshuffling in the shipping line partnerships. This restructuring, and in particular the partnership between Hapag Lloyd and Maersk, will be very positive for Rotterdam, predicts Van der Laan: 'Gemini is opting for a hub-and-spoke model, which includes only a few ports as a hub, from where volume will be distributed to other (spoke) ports. While Antwerp and Le Havre will serve as spoke ports, Rotterdam remains an important hub.' Rotterdam also maintains its role as a key main port for a number of other shipping alliances.

If there are no drastic geopolitical or economic disruptions, Van der Laan expects the Northwest European container market to grow 2-3% in the coming years. 'In the coming years Rotterdam is expected to grow at that pace, but once the supply chain is normalised and our capacity expansions have been completed, we foresee a growth that will outpace the market,' he concluded.

Ready for the future

To facilitate that growth, the port of Rotterdam will expand its container capacity, sustainably and within its existing physical footprint. The capacity of the hinterland chain will need to accompany the seaside capacity growth. If that doesn't happen, everything will grind to a halt. The development and implementation of smart data solutions, such as Rail Connected, Routescanner, Nextlogic, PortAlert and the Portbase developments , provide an important contribution. The partnerships between the various parties in the supply chain are another important factor.

Increasing port performance is a key priority, to ensure that increasing container volumes will still be handled (cost) effectively and reliably in the port and transported to/from the hinterland. The port is also investing in the sustainability of the entire chain. The expansion of the container terminals is fully CO2 neutral and the port is installing shore power and enabling the transition to new fuels for transportation. The industry is on the brink of a system change, where improvements will require multi-modal decisions. The Port of Rotterdam Authority does not see the supply chain as individual modalities, but as one coherent unit. Strong infrastructure is essential: advancements in digitalisation, sustainability and efficiency will not be possible without this solid foundation.